“Buy low and sell high”

It definitely sounds easy but it is far from easy for me. There is a glamourous ring to being a stock trader in our financial city. Stock traders can afford big houses, nice cars and expensive wines. They only work during trading hours and once past trading hours, they are having fun at the bars doing “networking”. No need to bring work home or stay past office hours.

My few attempts on doing personal trading had never end up great. When I thought the stock could never go any lower after I bought, it fell another 20% the next day. My attempts at currency trading were worse. Every time I felt that it was a sure win, the position went the other way. I was so confident with my “skills” that I asked whoever who wants to make money for sure to bet against me. If I buy long and you sell short, you are 100% guaranteed to make money.

How then can I get involved with the stock market or plan to retire early in investing in stocks?

Fortunately, investment is not trading. We can adopt some discipline so that we can win in the long term.

In Picking our own stocks, we covered buying stocks in industries or companies that we have some inherent knowledge professionally or we interact with in our daily lives to provide us the investment instincts. We can hold these stocks for the long term (instead of trading) and continue to add onto our holdings by buying more during market dips.

For eg, I bought a renewal energy ETF and stock more than 15 years when there were many articles on how renewal and solar energy will be prevalent. The ETF and stock did not do well for many years. It is only in the recent years that I managed to get some good returns. Fortunately, I didn’t buy the ETF and stock for trading purposes. I would have lost money simply by holding on to the ETF and stock.

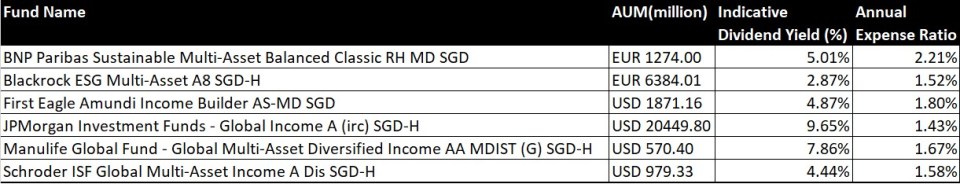

If we do not want to pick our own stocks, we can depend on mutual funds or ETFs that help us diversify across a basket of stocks. We can use Regular Saving Plan (RSP) to help us diversify the purchase over time (so we do not end up buying only when they hit all time high). We covered this in how to start investing.

So busy professionals can plan to retire early by investing in the stock market. Perhaps we will not get the big houses and nice cars, but this is a slow and steady way to work towards having a steady retirement income.

TRI-O RETIREMENT PLAN is a simple way to help you get started on your retirement planning. Learn the FUNDAMENTALS and HOW TO GET STARTED. There is also a spreadsheet to help you CALCULATE your monthly savings and your project monthly income at retirement. You can check out our BLOGS on topics pertaining to retirement planning. Feel free to CONTACT US if you have any questions or comments.