Some readers upon reading from our site Tri-O Retirement Plan are keen to start investing for retirement planning. There are quite a few instruments which can provide regular retirement income as listed in our INVESTMENT page. For this particular blog, we will cover investment in Mutual Funds or Unit trusts. One advantage for this instrument is that many financial institutions or platforms allow investment in mutual funds using Regular Saving Plan (RSP).

RSP is suitable for busy executives or employees. It automates the purchase of investment products on a monthly basis. For busy executives, it is almost a “set up once and forget about it” type of operation. The other advantage is it enforces the discipline of investment over different market conditions. We, as humans, tend to get emotional when market goes up or down and may end up buying high and selling low (which is bad). RSP helps remove this need to make any buy decision in the accumulation phase and hence provides diversification of investment over time.

On our INVESTMENT page, we spoke about having an INCOME PORTFOLIO and GROWTH PORTFOLIO in INVESTMENT “O”. We recommend using RSP on large mutual funds which provide regular dividends for the income portfolio and RSP on high growth thematic funds for the growth portfolio.

The specific mutual fund or ETF to invest in will depend on which country you are from and which financial institution you trust your money and investment with. There is also a currency decision to make based on the country you are from as some mutual fund or ETF may or may not offer them in your country’s currency.

Using Singapore as an example which we are from, there are many options that we can choose from. Most financial institutions in Singapore allow investment in mutual funds using RSP and the RSP amount can start with $100 per month. You can choose from pure equity funds, bond funds or balanced (consists of equities and bonds) funds. They have different characteristics on how they fluctuate with the market and dividend they provide. Using the funds selector from your financial institution, you can pick up different attributes of funds that you are interested in.

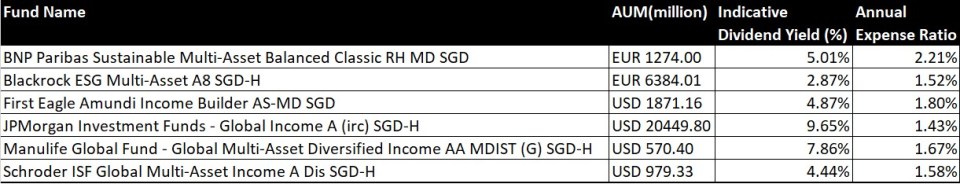

These are some examples of balanced funds.

We like funds from large asset management companies like Blackrock, JP Morgan, Fidelity, Goldman Sachs, Vanguard etc and large fund sizes (at least $1 billion of AUM – asset under management). Look for funds with lower annual expense ratio so that it does not erode your dividend or growth of the fund.

These are examples of equity funds

And these are examples of Bond Funds

The above funds (balanced, equity or bond funds) are good to be considered as part of your INCOME PORTFOLIO of your INVESTMENT “O“. Assuming you have more than $300 per month (in the context of Singapore) allocated to the income portfolio of your INVESTMENT “O”, you can look at buying three funds, one from each category, to spread out your risks as well as to learn their different characteristics. For eg, a bond fund tends to fluctuate less than an equity fund. It means it will not go down as much in value in down markets but of course, it will not gain as much in a buoyant market.

We are not recommending any specific funds but provide broad categories that you can consider. Do some research from your financial institution websites and read the fund fact sheets. Please do take note that your financial institution may layer in a sales charge for any funds bought. The sales charges are usually lower for funds that you can buy online, without going through a banker or sales person. Look for a financial institution or platform that you are comfortable with in terms of security, customer service and charges. Please spend time doing your homework instead of relying solely on bankers or financial product sales people. They will tend to push for products that they receive higher commission and may not have 100% of your best interest at heart.

As for the GROWTH PORTFOLIO in INVESTMENT “O”, you can look at thematic funds. For eg, if you are a big believer of clean energy or autonomous vehicles, there are funds that focused on investing in these companies. When autonomous vehicles become mainstream, your fund may start performing very well. These funds are usually smaller, riskier, fluctuates more widely and do not pay regular dividends.

As an illustration, if your monthly contribution to INVESTMENT “O” is $1,000, you can allocate 80% to INCOME PORTFOLIO and 20% to GROWTH PORTFOLIO. For your income portfolio, you can pick 4 funds (1 equity fund, 1 bond fund and 2 balanced fund) with a RSP of $200 each per month. For your growth portfolio, you can pick 2 thematic funds with a RSP of $100 each per month. This strategy will provide you sufficient risk diversification.

Investment is a big topic. This blog just touches on some basic concepts and possibilities for retirement planning. Subscribe to our newsletter if you are keen to read more blogs in these areas.

TRI-O RETIREMENT PLAN is a simple way to help you get started on your retirement planning. Learn the FUNDAMENTALS and HOW TO GET STARTED. There is also a spreadsheet to help you CALCULATE your monthly savings and your project monthly income at retirement. You can check out our BLOGS on topics pertaining to retirement planning. Feel free to CONTACT US if you have any questions or comments.